Maine sales tax calculator

Just enter the five-digit zip code. Just enter the five-digit zip code.

Maine Sales Tax Guide And Calculator 2022 Taxjar

This includes the sales tax rates on the state county city and special levels.

. Use our simple sales tax calculator to work out how much sales tax you should charge your clients. The state sales tax rate is 55 and Maine doesnt have local sales tax rates. Enter the Amount you want to enquire about.

The Maine ME state sales tax rate is currently 55. So whether you live in Maine or outside Maine but have nexus and sell to a customer there you would charge. In short if the vehicle is registered in the state of Maine then the Maine car sales tax of 550 will be.

Just enter the five-digit zip code. In zip code Enter the zip code where the purchase was made for local sales tax Whenever you make a purchase at a licensed Maine. You can always use Sales Tax calculator at the front pagewhere you can modify percentages if you so wish.

The average cumulative sales tax rate in Lewiston Maine is 55. Lewiston is located within Androscoggin. Maine sales tax details.

Sales tax is not collected at the local city county or ZIP in Maine making it one of the easier states in which. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what. Maine Sales Tax Calculator Purchase Details.

Your household income location filing status and number of personal. This state sales tax also applies if you purchase the vehicle out of state. If you have any questions please contact the MRS Sales Tax Division at 207 624-9693 or.

Maine all you need is the simple calculator given above. Farmington Maine Sales Tax Calculator 55 Average Sales Tax For Farmington Maine Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how.

Input the amount and the sales tax rate select whether to include or exclude sales. Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what. To know what the current sales tax rate applies in your state ie.

Sales and Gross Receipts Taxes in Maine amounts to 24 billion. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Sales Tax Calculator Calculate CALCULATING Before Tax Amount000 Sales Tax000 Plus Tax Amount000 Minus Tax Amount000 If youre selling an item and want to receive.

Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how what. Retailers can then file an amended return at a later date to reconcile the correct tax owed.

Maine Income Tax Calculator Smartasset

Maine Vehicle Sales Tax Fees Calculator

How To Charge Your Customers The Correct Sales Tax Rates

Maine Sales Tax Information Sales Tax Rates And Deadlines

Sales Tax On Grocery Items Taxjar

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Maine Vehicle Sales Tax Fees Calculator

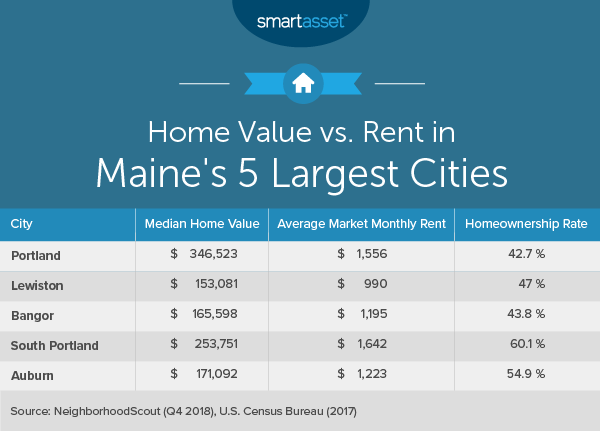

What Is The Cost Of Living In Maine Smartasset

Item Price 70 Tax Rate 18 Sales Tax Calculator

Tax Calculator For Items Flash Sales 56 Off Www Ingeniovirtual Com

Maine Sales Tax Table For 2022

How To Calculate Cannabis Taxes At Your Dispensary

Maine Vehicle Sales Tax Fees Calculator

Sales Tax Calculator Taxjar

Sales Tax Calculator

Maine Sales Tax Small Business Guide Truic

Maine Vehicle Sales Tax Fees Calculator